Expect uncertainty – be a better investor

Investment Corner

As investors, if there is one lesson to take away from the last decade, and probably from any previous decade we wish to examine, it would be that life and investing are uncertain. It will only be a matter of time before some event occurs, which we never considered as a possibility, and rocks our world with market reaction we didn’t consider. This occurs in both the positive as well as negative directions.

Events in the last couple weeks, which created excessive market volatility, are an example. One of the best records of long-term success as a money manager belongs to Jean-Marie Eveillard, former portfolio manager and now senior advisor to the First Eagle Global Fund. Jean-Marie’s favorite saying is, “Life is uncertain – invest with a margin of safety”. Another way to interpret this phrase is to consider what might go wrong with more importance than what might go right when making investment decisions.

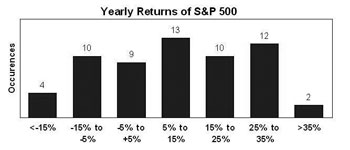

I first used the chart pictured here a couple years ago to illustrate how the "average" return expectation for owning a diversified portfolio of stocks over time was 10 percent per year. However, there were many more occurrences of annual returns outside of the 5 to 15 percent range, than there were near the long-term average result when many years were averaged together. The chart has now been updated to include the results of 2008 and 2009.

The message, I believe, is that investors should expect a wide variety of results on the path of their investment time horizon. Of course, the additional message is that if you abandon your plan at moments of maximum fear or greed, you will likely obtain a lower result, and this is the unfortunate part of the interactions of emotion and investing.

There are many potentially successful techniques for navigating the financial markets' cycle and the uncertainty of when tremendously good and tremendously bad things will cause the markets to reach states of euphoria and panic. They all involve some level of planning for an appropriate mix of different asset classes, rebalancing back to targets when the portfolio is out of whack due to market activity, and perhaps some rules on when you will invest new capital into the plan or make decisions about emphasizing certain assets over others at particular periods of time based on the information available.

But, above all, if we just acknowledge each and every day that an event unforeseen and unexpected could occur and either positively or negatively impact our portfolio, we may be ready to deal with the emotions created by the event and seize the opportunities presented more effectively than when we wake up each day hoping for normal. There is no normal in the economic and investment cycle – trust me I’ve looked. Our perception of what normal should be is an average of our total experiences when viewed in hindsight, but very rarely do those conditions exist on a particular day, and when they do, they are fleeting.

Expect uncertainty – it’s what makes life exciting.

Tom Breiter is president of Breiter Capital Management, Inc., an Anna Maria based investment advisor. He can be reached at 778-1900. Some of the investment concepts highlighted in this column may carry the risk of loss of principal, and investors should determine appropriateness for their personal situation before investing.