Commercial real estate –

crisis or no big deal

Investment Corner

Obviously, real estate is a sore topic for many homeowners and investors over the last few years and will likely continue to be a slow area for some time to come. Recent evidence is that we may have reached the bottom of the price cycle for residential real estate, but there is no shortage of prognosticators holding forth on the next crisis, which they believe will be commercial real estate.

Commercial real estate consists of many types of properties ranging from office buildings to malls to industrial and warehouse properties. As the economic recession of 2007–2009 (likely ended earlier this year) has unfolded, some companies have struggled to pay rents and mortgages on properties leased or purchased when the economy was stronger.

Those predicting doom and gloom for the commercial sector point out that large scale defaults by companies owning properties will hit the banking system with another wave of problems and potentially throw the financial system back into crisis mode.

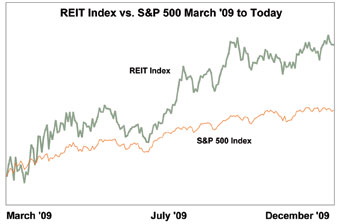

Despite this generally negative consensus, prices of bonds issued by companies owning real estate have been rising, and prices of Real Estate Investment Trusts (REIT’s), which are real estate holding companies, have outperformed the stock market since the March lows by a wide margin.

I have mentioned in articles many times that the prices of financial vehicles related to a particular market segment tend to fall before headline news turns bad and rise before we all feel good again. This appears to be happening in the commercial real estate space.

Some other data support the minority opinion that commercial real estate won’t send us into an economic tailspin. Some of these factors include:

1. Commercial real estate never became as overbuilt as the residential market during the boom, which peaked in 2006, so there is less vacant supply to be worked through as the economy recovers.

2. More than two-thirds of commercial property mortgages are held on the books of the bank underwriting the loan, compared to only about one third of residential mortgages. The implication is that if the institution was willing to hold the loan, as opposed to selling it, there was probably a higher level of lending standards involved in the loan process, and the loans may be less likely to default.

But, there is still a problem to be dealt with and estimates are for losses on bad commercial loans of over $100 billion during the next two years. These losses will cause problems for some local and regional banks, but the larger banks and insurance companies have sufficient reserves to handle these write-offs.

In summary, be wary of investing as an equity owner in smaller banks unless you can verify their real estate loan exposure. Depositors are safe at these institutions up to the limit of the FDIC insurance coverage. If buying commercial property in the form of REIT’s, a fund or exchange traded fund holding a broad spectrum of properties will be the easiest way to reduce default exposure.

Tom Breiter is president of Breiter Capital Management, Inc., an Anna Maria based investment advisor. He can be reached at 778-1900. Some of the investment concepts highlighted in this column may carry the risk of loss of principal, and investors should determine appropriateness for their personal situation before investing.