Sun readers review Cordon Bleu memoir

SUN PHOTO/LOUISE BOLGER

Sandra Ashbrook solves

problems using classic chiropractic principles.

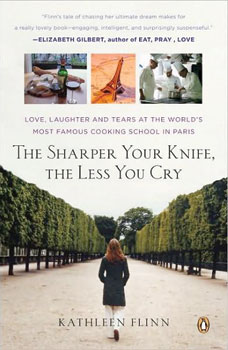

The Sun Readers met recently to discuss "The Sharper Your Knife, the Less You Cry: Love, Laughter and Tears in Paris at the World’s Most Famous Cooking School" by part-time Island resident Kathleen Flinn.

Flinn had turned 36 when she suddenly lost her mid-management corporate job in London. A friend, the man who later became her husband, challenged her to pursue her dream and take the course at Le Cordon Bleu in Paris.

Flinn, who had worked as a journalist, took the challenge, successfully completed the three levels of classes at the school, and turned her experience into this book.

The author lives half of the year here on Anna Maria and the other half in Seattle.

The fact that Flinn lives part-time on the Island was of particular interest to the Sun Readers, and one reader had met the author when she was doing a book signing at a wine tasting event at Time Saver in Holmes Beach.

"She seemed really nice and interesting," Joan Dickinson. "She was someone I think I’d like to sit down and talk a while with."

Birgit Quam, who has never met Flinn, said reading the book made her wish she could sit down and have a glass of wine with the author to talk over her Parisian experience and her life on the Island.

Flinn’s book chronicles the classes she took, the teaching chefs, her fellow culinary students, shopkeepers she encounters in her neighborhood, details about her neighborhood and life in Paris.

There was admiration for Flinn’s strength in having the courage to enroll in the school.

"She had a dream and pursued it to the limit," Betsy Smith said. "Not many of us could do that. It takes guts."

The descriptions in the book were of particular interest to the readers.

"I really like reading recipes, and it was interesting to read about what they cooked in the classes," Louise Bolger noted.

Other readers were also interested in the cooking. " I liked reading about how they organized the food and the workspace."

"When I read her description of how to make mashed potatoes — ‘take equal parts butter and potatoes’ —that’s way too rich," Quam said.

"The descriptions of those chefs, how temperamental and critical they were was something I liked," Charlene Doll said. "I don’t cook. I like plain food. I don’t like sauce, and if it needs sauce, I add ketchup."

All the talking about the classes and the food in the book and Doll’s statements about food in her life, brought laughter, and then the discussion took a turn to the centrality of food and eating in the human experience.

"There is the whole ambience of food and nurturing in this book," Dickinson remarked.

Bolger said she grew up with family dinners taking precedence over other activities.

"And I still like to have dinner parties where we sit around the table for hours talking," she said.

Smith said she isn’t much of a cook.

"When I first got married, somebody gave me a book called "101 Ways to Cook Hot Dogs," she said. "I went through at least 70 of them before my husband said he had enough hot dogs."

After the laughter died on that one, Quam mentioned that growing up in the North Friesian Islands where there wasn’t much to eat, her family’s diet consisted primarily of sea gull eggs and wild rabbits.

Everyone wanted to know what a sea gull egg was like.

"The yolk is bright red," she reported. "If you make pancakes, they’re pink. That’s what we had."

Quam said that because of her childhood, she doesn’t waste anything at all. She uses her leftovers by making a big pot of soup, much like Flinn describes the "minestrone" her mother made to use up leftovers.

Discussing the book brought some interesting turns in the conversation. Almost everyone liked certain aspects of the book with the exception of Bobbie Gordon, who is just not a fan of memoirs.

The readers rated the book as a three on a five-point scale, with five representing the best book the readers have ever picked up.

They would recommend it to Island residents. They found the fact that Flinn spends part of the year here and had her wedding on the beach to be of particular interest.

They also said they’d recommend the book to anyone who likes reading about cooking.

Reader Cindi Mansour, who was unable to come the evening of the discussion, said that she had loved the descriptions of Paris, and she’d recommend the book to anyone who loves that city.