ANNA MARIA ISLAND – In the midst of a global pandemic, 2020 was a stellar year for Anna Maria Island real estate agents.

For the sixth consecutive year, Sato Real Estate Realtor, broker and co-owner Jason Sato led all Manatee County and Anna Maria Island Realtors in total sales and listing volume.

According to the 2020 Agent Market Share Report for Manatee County, Sato sold 48 properties, listed 58 properties and generated roughly $153 million in total combined volume. Forty-seven of the properties Sato sold were on Anna Maria Island, where he does most of his business.

Judy Kepecz-Hays ranked second on the Island with $52.4 million in combined total volume, followed by Gregg Bayer at $43.6 million.

Duncan Real Estate owner Darcie Duncan ranked eighth in Manatee County with 18 properties sold, 34 properties listed and a total combined volume of $46.6 million. She ranked fourth on the Island with nine properties sold and 23 listed for a combined volume of $37.3 million.

Rounding out the top 10 on the Island were George DeSear at $35.5 million, Liz Blandford at $29.2 million, Hannah Hillyard at $25.6 million, Shellie Young at $22.9 million, Trevor Bayer at $22.6 million and Ryan Sheck at $22 million.

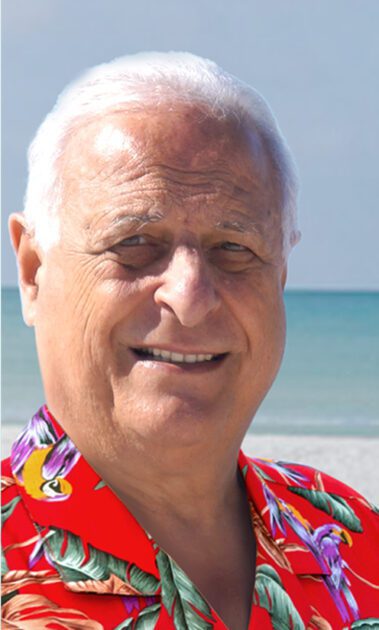

Alan Galletto, from Island Real Estate, ranked 11th with four properties sold, 17 listings and a total volume of $17.5 million.

Market insight

Sato, Duncan and Galletto shared their thoughts on the year that was.

“My total was $153.9 million. It was double what I did last year. Last year was a good year, this year was just incredible,” Sato said.

“There was so much demand to be on the Island. I think part of it was the fact was that Florida was open and people can come here. Florida has been as close to normal as you can get in a pandemic. People in the stricter lockdown states wanted to get away. I think for people buying a second home, this pushed them to do it sooner rather than later. People can use their second homes a lot more right now because you can work remotely, and the kids are in school remotely.

Here, there’s natural social distancing on the beach and you have the ability to move around outside and enjoy the Island. If you’re going to buy a second home and can only be here a few weeks a year you’re not as included to make that jump,” Sato said.

“This year my team did $105 million in sales. It was a great year,” Duncan said. “We’re seeing younger people with families buying second homes, and we’re seeing retirees, too.”

“It was a fantastic year,” Galletto said. “There were more properties sold on the Island in 2020 than any other year, by far. The previous highest number on the Island was back in 2005 or 2006, when 438 properties were sold. In 2020, 579 properties were sold. Everybody wants to move to Florida.”

“The buyers we’re seeing are not so much rental-driven,” Duncan said. “They’re here to live, with second homes. Obviously, COVID created more demand because of our outdoor lifestyle and we’re seeing people working remotely and schooling remotely. We’re seeing people relocating their families here, which is wonderful thing.”

“My typical buyer isn’t buying it for the return on investment, it’s a second home,” Sato said. “If you’re buying a house just to rent – and trying to get a 5-10% return on investment – that’s not happening because the prices are where they are. A lot of people rent out their second homes to help pay the taxes, insurance and upkeep, but the house is for them.”

“I’ve been out here 30 years and the demand has never been this high and the inventory has never been lower,” Galletto said. “The previous low was something like 300 properties for sale on the Island back in 2003, 2004 and 2005. Right now, the inventory is 135 properties for sale.

Thirty years ago the buyers were in their 60s. Now they’re in their late 40s and early 50s. They’re all second and third homes. The majority of the buyers are from the Midwest – and a lot of people in Tampa have second homes here,” Galletto said.

“When you’re buying here, two-thirds to three-quarters of what you’re buying is the land and not the house. An acre on the Gulf now is $6 million. A hundred-by-hundred lot on the Gulf is $3 million. A lot in middle of the Island, four blocks from the beach, is $400,000. I expect the prices will continue to rise. They’ve been going up on average about 7% per year since 2000. And sales may be a little slower in 2021 because there’s not enough inventory.

Team efforts

“Grace Wenzel, my sales assistant, is a big part of my success,” Sato said. “Monica Reid, our office manager, is too. And I have really loyal customers that have confidence in me and pass my name on to other people. I want to thank them too. Overall, this was our best year. Our agents did well and we love that. We’re able to provide them with a lot of opportunities and they’re making the most of it,” Sato said.

Duncan credited some of her team’s continued success to their knowledge of the Island market and their longevity in it.

“We are a hard-working team and our team is doing very well,” she said.

A Paradise Realty

A Paradise Realty real estate agents Al and Helen Pollock provided their market insight via email.

“2020 started out normal until covid-19 hit then was quite slow until mid summer when sales picked up dramatically and they have been extremely strong the rest of the year. Anna Maria Island, back in 2012, had about 700 listings at any time. In the last several years it has been about 350 listings. Right now it is 116,” their email said.

“It is definitely a seller’s market, with prices going up, and it should continue to remain quite strong. With the inventory low, the trend will be for closing prices to be close to or above the asking prices. Lately, when buyers have made an offer on a property, there have been multiple offers on the same day. With low inventory, one can expect multiple offers and prices to continue to increase,” the Pollocks said.